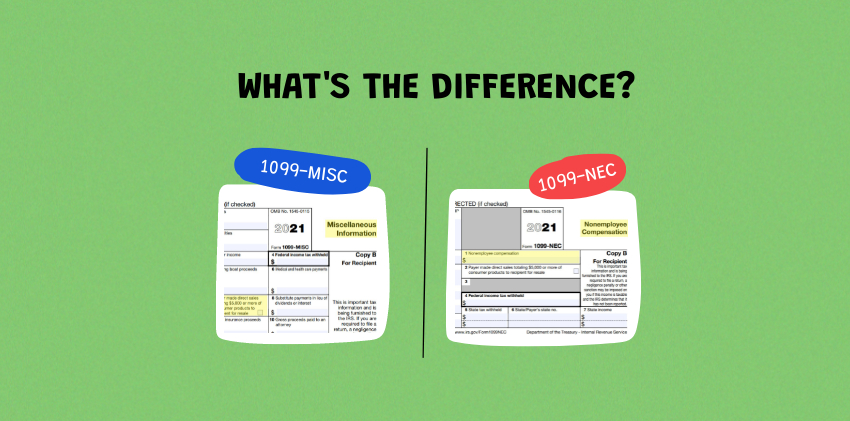

Form 1099-MISC vs. Form 1099 NEC

If a taxpayer has self-employed income, they will be issued a Form 1099-NEC or Form 1099-MISC if certain conditions are met. Form 1099-NEC had not been used since 1982, but in 2020 the IRS reinstated Form 1099-NEC to report nonemployee compensation that used to be reported on Box 7 of Form 1099-MISC.

You will get a 1099-NEC instead of a 1099-MISC if:

- You worked as a contractor or freelancer

- You were paid for your self-employed goods or service

- You previously received these payments on 1099-MISC

Form 1099-NEC

Any amount you were paid will be in Box 1. If any federal tax was withheld, it will be in Box 4. All any state tax or income will be listed in Boxes 5-7.

Form 1099-MISC

Form 1099-MISC, Box 7 is no longer used to report nonemployee compensation because this is now done via 1099-NEC as described above. The 1099-MISC is now primarily used to report miscellaneous income, such as rent or royalties.

If you received a 1099-MISC but need a 1099-NEC, and you can contact the payer directly and ask them to send you a 1099-NEC instead.